LuxLeaks and tax rulings – chronology of events in Luxembourg and on European level (ECOFIN, Code of Conduct Group on business taxation, European Commission)

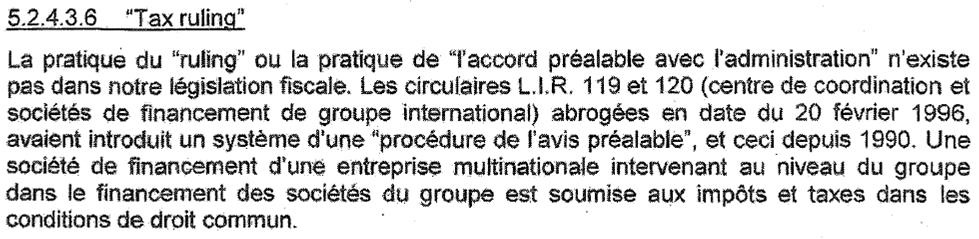

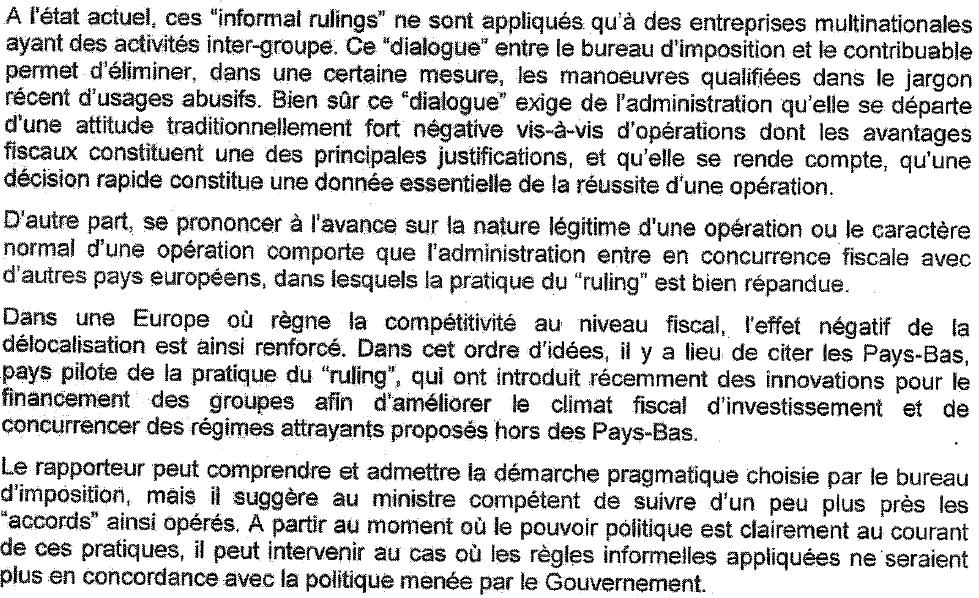

1997: Report Krecké to the government of Luxembourg

From the missing page which became only public in 2015, we learn that Luxembourg knew very well that their tax rulings do harm to neighbour countries.

„Informal rulings“ are only granted to multinational corporations. Given the tax competition in Europe, this practice is to the detriment of neighbour countries:

1999: study from Simmons & Simmons on administrative practices of the Member States

From the Simmons & Simmons Study we learn that since 1999 the European Commission knows very well that there is a lot of discretion in Luxembourg when granting rulings and that Luxembourg hasn’t adopted the OECD guidelines on transfer pricing (“arm’s length principle”) and doesn’t appear to have adopted an approach consistent with them:

Selected sections from the Simmons & Simmons study:

(…) administrative discretion which allows the negotiation of a favourable tax treatment. (…) the degree of discretion and flexibility is such as to be an important factor in the location of

business. In the past this has also been the case (…) in Luxembourg.

(…) the existence of a particular tax regime allowing for the exercise of administrative discretion which has been sanctioned by legislation (as (…), at least in the past, in Luxembourg) is a fairly consistent indication of the existence of a practice likely to influence the location of business. In such cases administrative practices reflect specific intent on the part of government to promote particular activities or businesses.

(…) Luxembourg. (…) there are statutory regimes requiring the operation of varying degrees of administrative discretion. Those regimes are overlaid or supplemented, to a greater

or lesser extent, by the ability to agree special treatment on a case by case basis.

(…) a majority of Member States either follow the [OECD transfer pricing] guidelines, or adopt an approach consistent with them. (…) and Luxembourg do not appear to do so (…)

1999 Simmons & Simmons study – country report Luxembourg

From the detailed country report of the study we learn that the legal basis for tax rulings in Luxembourg only is good faith.

Selected sections from the 1999 Simmons & Simmons country report on Luxembourg:

There is no specific legislation providing for tax rulings or other similar advance agreements in relation to the level of taxation or tax treatment.

The administration is bound by the general principle of good faith, serving the imperative need to assure legal reliability whenever the taxpayer, having received the ruling, takes action in accordance with the intentions described in his application. (…) The principle of good faith is a very general one. It is not limited to tax law and extends beyond public and administrative law.

There is no published guidance in connection with tax rulings.

On 3 June 2003 (Council doc. 10126/03 FISC 93), the ECOFIN Council approved the proposals for the exchange of information in individual cases arising from the Code of Conduct Group’s work on transparency and the exchange of information in the area of transfer pricing

ECOFIN Council of 2 December 2008 on the Future Work Package (2009-2011). The work package has 6 items including administrative practices (i.e. rulings). The 2008 Work Package focuses on transparency and the exchange of information in the area of transfer pricing (Later on, the 2011 Work Package will focus on exchange of information on cross-border rulings).

On 23 September 2009, the Code of conduct (CoC) group has a meeting about administrative practice with regard to exchange of information on transfer pricing. It is clear from the background documents that no member states have spontaneously and systematically exchanged information about their rulings in the past, not a single one. 24 member states also confirmed they haven’t received anything. From this it follows that the obligation since 1977 to spontaneously exchange information is not implemented and the Commission knows about this at least since 2009.

On 18 November 2009, the Code of Conduct Group held an initial exchange of views on this issue. The discussion focussed on Member States replies to a questionnaire prepared by the Commission Services. The reply from Luxembourg makes clear that At that stage, no concrete conclusions could be drawn, nor did the Group agree on specific follow-up actions.

On 4th March 2010, the MS discussed what are harmful rulings and how to improve transparency of rulings practices and exchange of information (especially for cross-border tax rulings).

On 20th May 2010, the EC presented some guidance notes about the three topics

- what are harmful tax administrative measures

- guidance on transparency of rulings

- guidance on exchange of cross-border information

A questionnaire of MS practices was also attached for this meeting.

In October 2010, Antoine Deltour leaves PWC

On 11 April 2011, the Code of Conduct Group agrees to keep administrative practices in the Work Programme 2011. Starting in 2011, the Group agrees to a review process with respect to administrative practices. All Member States have been invited to share with the Group their knowledge or suspicion about potentially harmful administrative practices of other Member States.

In summer 2011, Antoine Deltour gets in contact with the journalisten Edouard Perrin

On 17 April 2012, at the Code of Conduct Group meeting, the Commission, once more, concludes that no MS has exchanged any rulings spontaneously. Therefore, the Commission suggests to discuss the implementation of its guidance notes on exchange of information on rulings with the Member States. Member States agree to collect more information on their exchange of information.

May 2012: Reportage „Cash investigation“

On 4 June 2012, the Member States discuss the responses obtained (NL and LU replied with very short comments, MT and FR didn’t reply at all and UK provided a huge reply). Not all Member States have replied but the EC notes that the attitude of tax administrators towards international cooperation on this matter is generally positive. MS have the legal framework to spontaneously exchange information and some MS have even put in place first steps to make it effective. No country can be taken as best model so the EC is suggesting developing a „Model Instruction“ which could help all countries when signing tax rulings.

18/19 July 2012: the preparation of such a Model Instruction was put on the agenda for the CACT meeting. At that meeting it was agreed as proposed by COM to ask the eFDT Steering Group to work out and prepare a draft of such a Model Instruction, discuss possible modifications of the existing e-form and report back to the CACT and, after that, to the Code Group

On 10 September 2012, the EC prepares a background document summarizing progress made since June 2012 and clearly writes “ The monitoring exercise discussed at the 17 April 2012 Code meeting showed that in practice no information on rulings was exchanged on a spontaneous basis“

On 30 January 2013, the Commission provided an update the Code Group on progress with the Model Instruction on cross-border rulings and asked the Code Group to agree the next steps regarding the transfer pricing aspects of the work.

On 20 March 2013, the Commission circulated a first draft of its Model Instructions for cross-border rulings and seeked feedback from the MS. it reminded that the legal basis for exchange of information was the 2011 directive on administrative cooperation. this Model Instruction already provided a definition of cross-border rulings and details on what to spontaneously exchange.

On 29 May 2013, the EC presented MS feedback to the Model Instruction. Apparently, at this meeting, MS agreed that further work on this topic was required and reported so to the ECOFIN (in their 6-monthly report). Two issues were particularly at stake: the incorporation of unilateral advance pricing arrangements into the Model and the monitoring of the implementation of the Model Instruction.

In January 2014, the Commission explained that further work by the CATC committee had been done and it would be useful to have MS‘ comments on the revised versions (revised Model Instruction and documents about guidelines for statistical monitoring).

On 3 June 2014, the (revised) Model Instruction was agreed by the MS.

On 5 November 2014, we have the Luxleaks scandal. The Commission commits to present a proposal on automatic exchange of tax rulings between the 28 MS.

On 12 December 2014, accusation of Antoine Deltour by the judiciary of Luxembourg

On 23 January 2015, accusation of the second source of the LuxLeaks revelations

On 12 February 2015, start of European Parliament’s special committee against tax avoidance and other measures similar in nature or effect

On 18 March 2015, the Commission presented its proposal for revising the directive on administrative cooperation and promote automatic information exchange on cross-border tax rulings.

On 7 April 2015, in the code of conduct , the European Commission requested to MS for feedback on the progress made in implementing the Model Instruction in their respective country and whether member States begun to automatically exchange rulings covered by the Model Instruction?

On 23 April 2015, accusation of Edouard Perrin

On 3 June 2015, Antoine Deltour is awarded with the European Citizens’ Prize

On 6 October 2015, the ECOFIN council agrees to a watered down version of the Commission’s proposal for automatic exchange of cross-border tax rulings.

On 21 October 2015, European Commission classifies some rulings as illegal state aid